[ad_1]

Two IRS brokers who blew the whistle on the political interference into Hunter Biden’s tax crimes filed a $20 million defamation lawsuit towards an legal professional for the president’s son late Friday, accusing him of behaving with “clear malice.”

IRS investigators Gary Shapley and Joe Ziegler accuse legal professional Abbe Lowell of retaliating towards them for his or her efforts in exposing the child glove remedy Hunter Biden was receiving in regard to his non-payment of taxes.

The lawsuit, filed in D.C. courtroom, states that the pair are bringing the case to “vindicate their reputations for the unimaginable and malicious hurt they’ve suffered.”

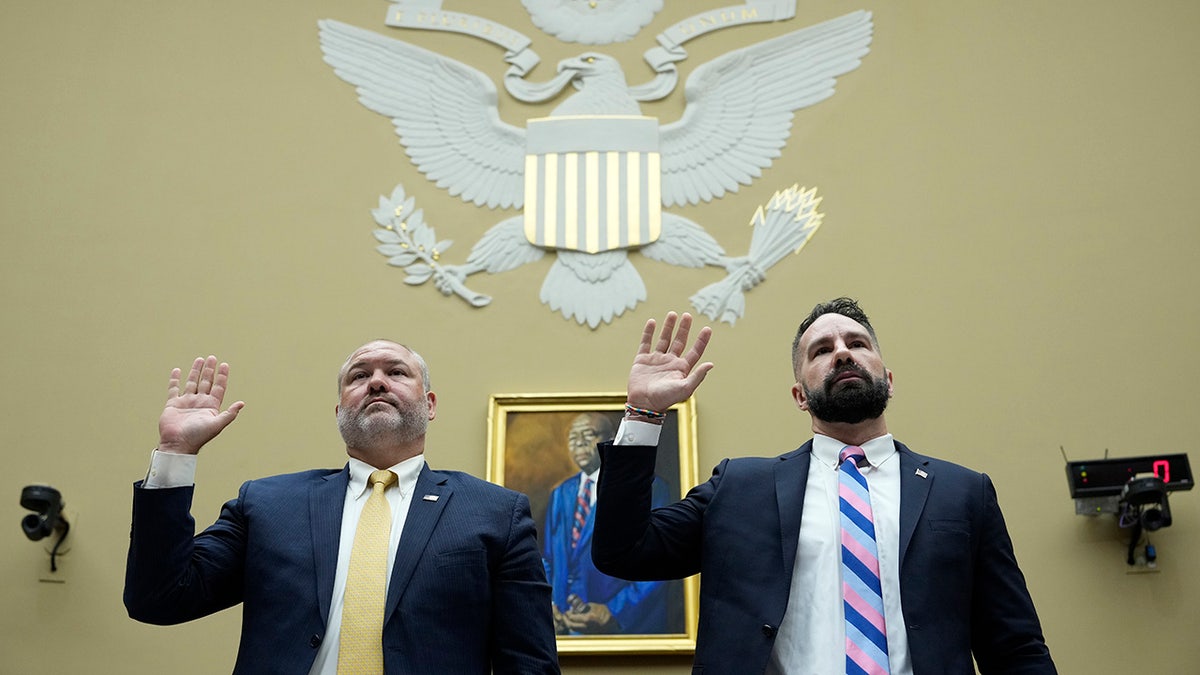

IRS Supervisory Particular Agent Gary Shapley, left, and Joseph Ziegler, an IRS Agent with the felony investigations division, take their seats at a Home Oversight and Accountability Committee listening to with IRS whistleblowers on July 19, 2023, in Washington. The pair are suing Hunter Biden’s legal professional Abbe Lowell for defamation (AP)

Shapley and Ziegler declare that as whistleblowers, they acted “with honor and integrity in exposing conflicts of curiosity, preferential remedy, and political motivations that they fairly believed had been interfering with the felony tax investigation of Hunter Biden.”

They declare that they acted in accordance with statute and that Lowell “falsely and maliciously” accused them of committing crimes, “specifically, the unlawful disclosure of grand jury supplies and taxpayer return data — even though they by no means publicly mentioned return[ing] data that was not already public.”

“Lowell’s malicious and false allegations, together with accusations that Shapley and Ziegler ‘dedicated felonies’ and ‘violated the legislation,’ had been printed to 3rd events, together with the media, and have severely harmed their skilled and private reputations,” the grievance states.

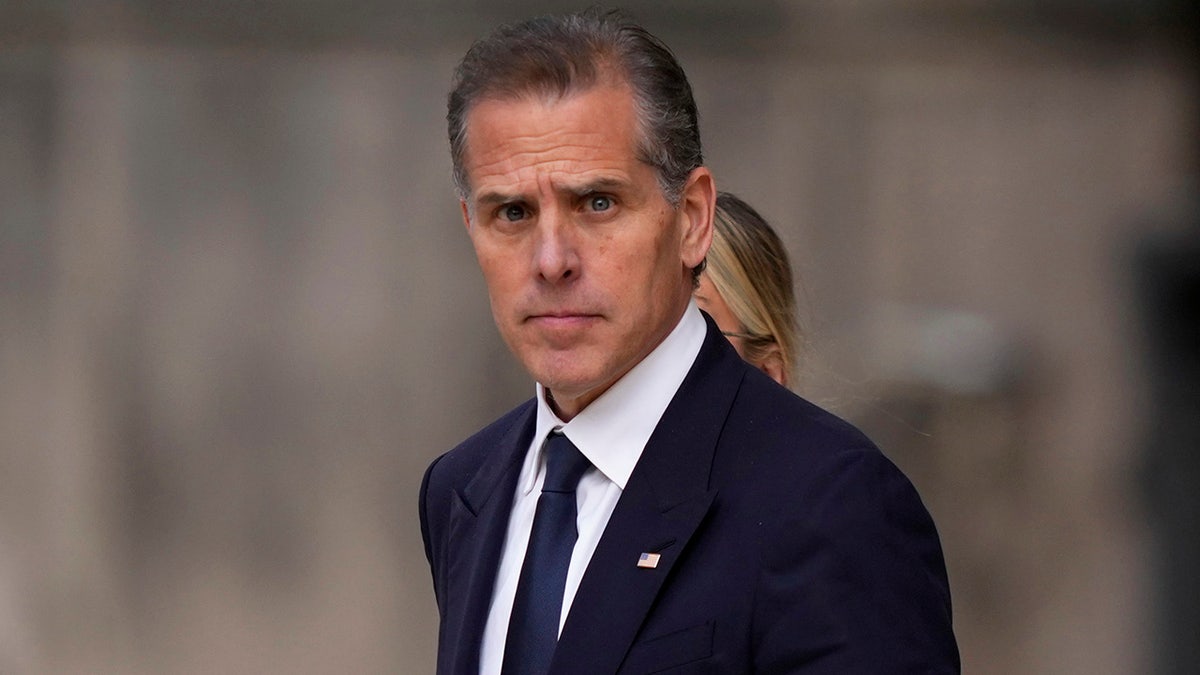

Hunter Biden, left, son of President Joe Biden, arrives with legal professional Abbe Lowell, proper, on the O’Neill Home Workplace Constructing for a closed-door deposition in a Republican-led investigation into the Biden household, on Capitol Hill in Washington, on Feb. 28, 2024. (AP Picture/J. Scott Applewhite)

Among the many situations cited within the lawsuit is a Sept. 14, 2023, letter that Lowell despatched to a number of congressional committees wherein the pair say Lowell falsely accused them of violating grand jury secrecy guidelines and the taxpayer confidentiality statute.

“This was an act designed to hurt Shapley and Ziegler by republishing the whole package deal of earlier defamatory falsehoods in a bigger discussion board,” the grievance states.

The whistleblowers additionally accuse Lowell of releasing Biden’s authorized group’s communications to the media that day, which included an April 21, 2023, letter written by one other Biden legal professional to the Division of Justice Deputy Lawyer Basic’s Workplace accusing one or each of the whistleblowers of leaking data to the press revealing that an investigation was going down, apparently in violation of federal legislation.

Final week, Hunter Biden pleaded responsible to 9 tax fees as a part of an “open plea” with out negotiating a take care of prosecutors. (AP Picture/Matt Slocum)

The grievance states that in December 2020, Hunter Biden had already publicly disclosed that he was the topic of a felony tax investigation.

Moreover, the whistleblowers accuse Lowell of releasing a letter to Division of Justice Inspector Basic, Michael Horowitz, which “falsely said that Shapley and Ziegler had disseminated ‘grand jury and taxpayer data, together with by way of a number of nationally-televised on-camera interviews of [Shapley],’ which it referred to as a ‘clear-cut’ crime unprotected by any whistleblower statute or different federal legislation.’”

They’re every suing Lowell for at the very least $10 million.

Fox Information Digital reached out to Lowell for remark through his legislation agency, Winston & Strawn LLP, however had been unsuccessful.

Shapley, who led the IRS’ portion of the Biden probe, and Ziegler, a 13-year particular agent inside the IRS’ Prison Investigation Division, alleged political affect surrounding prosecutorial selections all through the Biden investigation, which started in 2018.

Supervisory IRS Particular Agent Gary Shapley, left, and IRS Prison Investigator Joseph Ziegler, proper, are sworn-in as they testify throughout a Home Oversight Committee listening to associated to the Justice Division’s investigation of Hunter Biden, on Capitol Hill July 19, 2023, in Washington, D.C. (Drew Angerer/Getty Photographs)

Hunter Biden beforehand secured a sweetheart take care of Delaware U.S. legal professional David Weiss, nevertheless it fell aside final yr after Shapley and Ziegler went public with their considerations.

Shapley has stated that selections “at each stage” of the probe “had the impact of benefiting the topic of the investigation.”

Moreover, Ziegler has stated that Biden “ought to have been charged with a tax felony, and never solely the tax misdemeanor cost,” and that communications and textual content messages reviewed by investigators “could also be a contradiction to what President Biden was saying about not being concerned in Hunter’s abroad enterprise dealings.”

Ziegler additionally alleged that federal investigators “didn’t comply with the strange course of, slow-walked the investigation, and put in place pointless approvals and roadblocks from successfully and effectively investigating the case,” together with prosecutors blocking sure questioning and interviewing of Biden’s grownup youngsters.

Final week, Hunter Biden pleaded responsible to 9 tax fees as a part of an “open plea” with out negotiating a take care of prosecutors. An open plea is the place a defendant pleads responsible to all the costs and leaves a choose to resolve on sentencing, with out an agreed-upon advice from prosecutors.

President Joe Biden and his son Hunter Biden hug on stage on the conclusion of the primary day of the Democratic Nationwide Conference (DNC) on the United Middle in Chicago, Illinois, on August 19, 2024.

Weiss charged President Biden’s son with three felonies and 6 misdemeanors regarding $1.4 million in owed taxes which have since been paid. Weiss alleged a sample by which Hunter didn’t pay his federal earnings taxes whereas additionally submitting false tax returns.

Within the indictment, Weiss alleged that Hunter “engaged in a four-year scheme to not pay at the very least $1.4 million in self-assessed federal taxes he owed for tax years 2016 by way of 2019, from in or about January 2017 by way of in or about October 15, 2020, and to evade the evaluation of taxes for tax yr 2018 when he filed false returns in or about February 2020.”

CLICK HERE TO GET THE FOX NEWS APP

Hunter Biden faces a most penalty of 17 years in jail. He stays free on bond till the sentencing date of Dec. 16.

Fox Information’ Brianna Herlihy contributed to this report.

READ THE COMPLAINT BELOW. APP USERS: CLICK HERE

[ad_2]